You run your business

We get you low rate funding.

Small Business Funding Solutions

75+ Lender's In Our Arsenal

New Businesses

Real Estate Investments

Scaling a Current Business

Personal Loans

All your working capital needs covered.

Flexibility to borrow from a pool of funds. You only pay interest on money that you use.

Business loan to pay for new or used equipment like vehicles, machinery or technology.

Get cash flow upfront in exchange for your unpaid invoices. Borrow up to 85% of invoice value.

Borrow money that repay via a percentage of your daily credit or debit card sales.

3 Fast & Easy Steps

1. Financial Assessment

We conduct a comprehensive financial assessment. This includes reviewing credit reports, understanding budget constraints, and identifying available resources.

2. Tailored Funding Solutions

Based on the assessment, we provide tailored assistance in improving credit scores and acquiring funds. We explore various funding options such as credit cards, loans, grants, etc., to bridge financial gaps.

Step 3. Get Funds

We review rates from our network of 400+ lenders. Once funding is secured, we facilitate a seamless transition back to your business.

Why Choose Us?

We understand small business.

Our people understand the kind of day-to-day challenges you're facing in your industry.

We take a big-picture approach

When reviewing your application, your growth potential is more important to us than your credit score.

We value one-on-one connections.

Our Capital Specialists build trusting relationships with each of their customers.

“We want to help your business grow and succeed”

We believe in American small business owners! We draw upon years of business expertise and have helped thousands of businesses like yours across America access capital. Our team is committed to making the process of obtaining financing faster and easier than ever before.

Hear What Our Clients Have To Say!

Working with Wize is always a great e...

I love Wize! They made me feel like family and genuinelly cared about my company. Would highly recommend to anyone looking to save time!!!

George Owens

Took a loan for equipment purchase

Took a loan for equipment purchase, guys thank you for helping me with the entire process. Great customer service.

Kim Wexler

Wize was extremely helpful with appro...

Wize was extremely helpful with getting me funding while other companies shut me down. Not only were they professiona..

Max Tanner from CRP Trucking

I received funding from Kaleb, great W...

Working with Kaleb is always a great experience. They are very knowledgeable and communication is great during the process....

Moe Bazzi from Chico's Gourmet Mexican

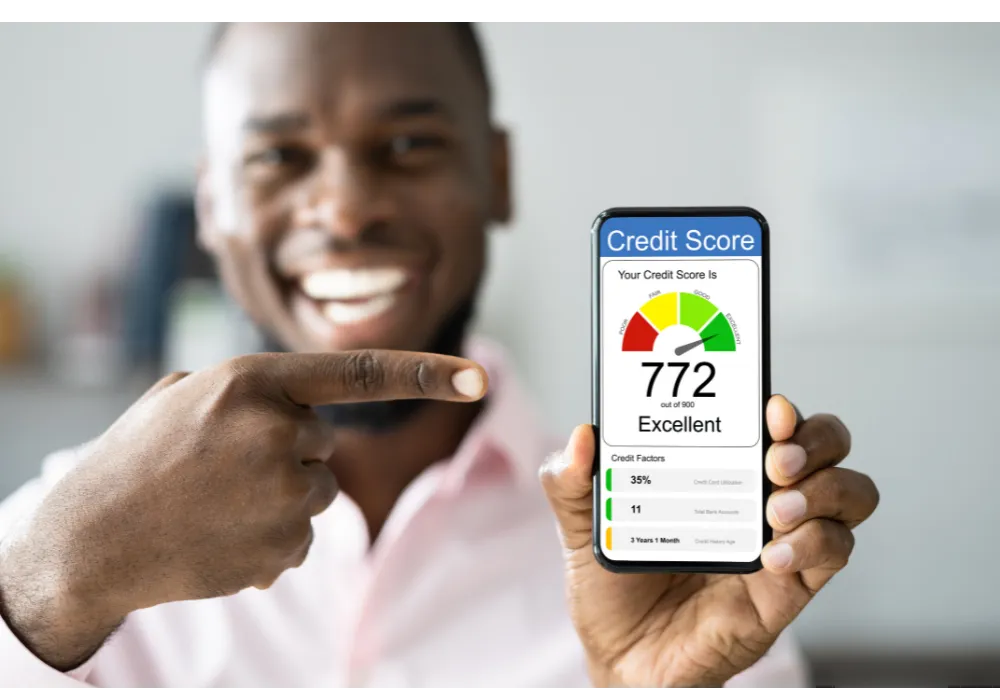

"Hold My Hand" credit repair

If your credit is stopping you from obtaining funding, we have a done-for-you credit repair program.

Results in less than 60 days, an online account to watch us work, and a satisfaction guarantee.

Get Pre-approved Now!

Due to high demand there will be no Rescheduling. If you cannot make the time, please don't Schedule the call.

Let's Talk

(734-673-8296

© 2024 Wize Funding LLC - All Rights Reserved, consectetur adipiscing elit. Maecenas commodo suscipit tortor, vel tristique sapien in sem nec, hendrerit